What Is an Advantage of Using the Multiple-step Income Statement

There are numerous benefits of using a multi-step income statement. A multi-step income statement reports much of the same information as a single-step income statement such as a businesss revenue expenses and profits.

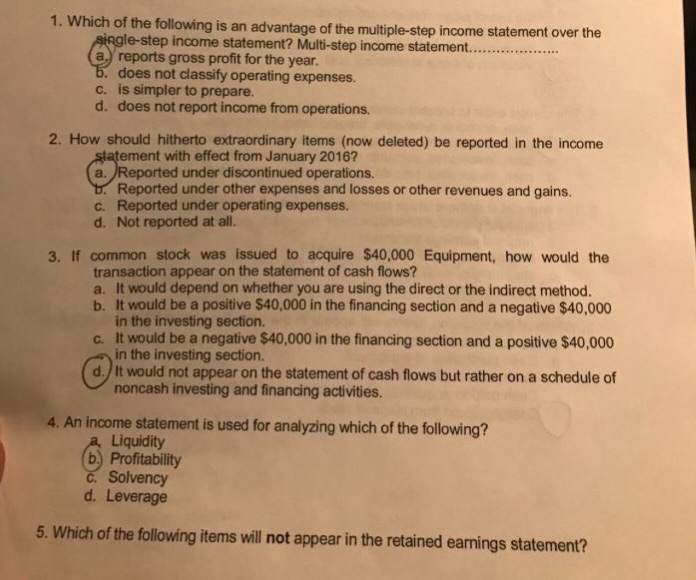

Solved 1 Which Of The Following Is An Advantage Of The Chegg Com

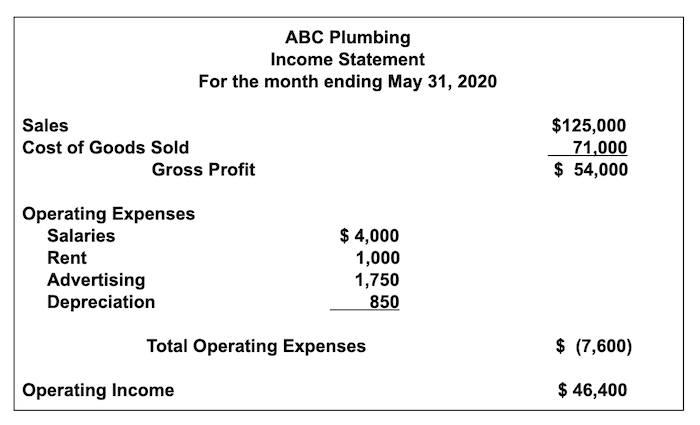

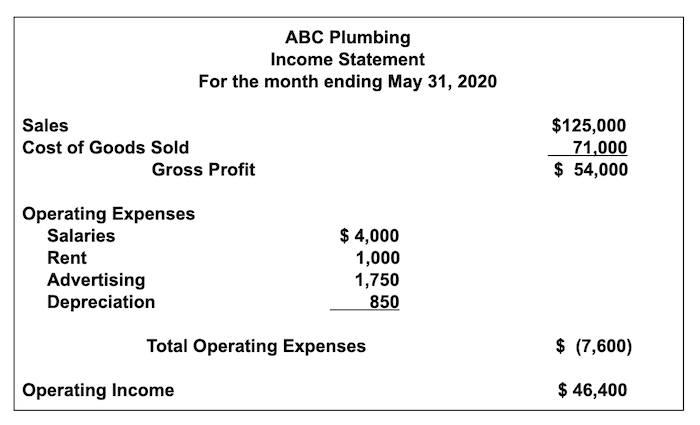

The most important of which are the gross profit and the operating profit figures.

. It highlights the components of net income. Benefits of Multi-Step Income Statement. Net income will be higher than net income computed using the single-step income statement.

What is an advantage of using the multiple-step income statement. Net income will be higher than net income computed using the single-step income statement. Use a multi-step income statement if.

A multi-step income statement on the other hand separates. A single-step income statement treats the cost of goods sold as expenses. It highlights the components of net income.

Assists in better analyzing the financial performance and the general health of. Seeing detailed gross profit also allows you to calculate gross margin which is gross profit divided by sales. Single-step statements are known to be concise and lacking details.

You need to report on gross profit. What is an advantage of using the multiple-step income statement. It is easier to prepare than the single-step income statement.

A major benefit of a multi-step income statement is the demonstration of gross profit. Based on a difference between all types of income with all expenses the net profit net loss of the organization for the period is determined. Net income will be higher than net income computed using the single-step income statement.

What is an advantage to using a multi-step income statement. Creditors and investors can evaluate how efficiently an organization is working and performing. This is done by subtracting the cost of goods sold in.

Advantages of a Multi-Step Income Statement. Gross profit is not a separate item. A multi-step statement is more comprehensive.

Following are the advantages of a multi-step income statement. You have a bigger company and you need more detail in your income statements. This allows you to see how much the company is earning on sales before operating income is considered.

Another useful income figure calculated by the multi-step format is operating income. When assessing a businesss financial performance to assist in making such decisions the single-step format will not be the most beneficial format. Gross profit is not a separate item.

The multi-step income statement provides a similar result as to what a single-step income statement provides with the only difference that it uses multiples stages or steps to compute the net income ie. Income on one hand and expenses on the other. Gross profit is not a separate item.

A multi-step income statement uses an itemized list of revenues and expenses. This allows you to see how much the company is earning on sales before operating income is considered. This is not the case in a multi-step income statement.

The one-step method assumes that all of its elements are grouped into two categories. One can easily judge how a company is performing its important functions indifferent from the other activities done by the company. Major benefit of a multi-step income statement is the demonstration of gross profit.

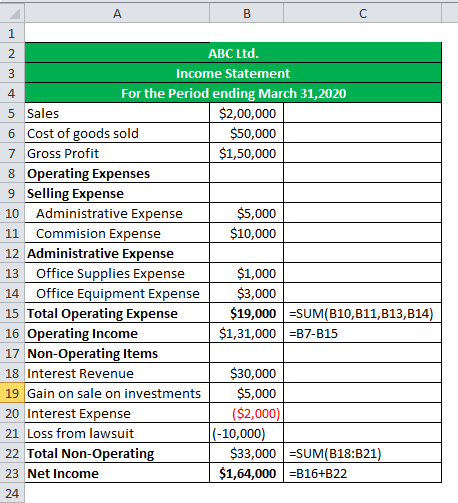

It is easier to prepare than the single-step income statement. This gives a better insight into the financial position of a business as well as the impact of non-operational items in the performance of the business. These include the higher level of detail and the multiple levels of income reported.

It highlights the components of net income. A multi-step statement is used for manufacturing businesses. Unlike a single-step format multi-step formats dont only focus on net income but offer an additional level of detail by calculating two more income-related figures.

When is a physical inventory usually. Multi-step income statement involves more than one subtraction to arrive at net income and it provides more information than a single-step income statement. The biggest advantage of using a multi-step income statement is that it shows operating and non-operating income as separate entities.

A Multi-Step Income Statement helps analyze the overall performance of a business. The multi-step income statement offers several advantages to users. Seeing detailed gross profit also allows you to calculate gross margin which is gross profit divided by sales.

A single-step income statement offers a simple report of a businesss profit using a single equation to calculate net income. Multiple subtractions are made to arrive at the net income figure where basically the operating. Single-Step Income Statement Example.

All income items are grouped in one section and all expenses in another The fixed costs and variable costs are broken out separately. Its no surprise that the main advantage of the multi-step format comes from the in-depth figures it provides. A businesss operating income is calculated by subtracting its operating expenses from its gross profit.

Operating revenues and expenses are. It is easier to prepare than the single-step income statement. However a multi-step income statement breaks down operating revenues and operating expenses versus non-operating revenues and non-operating expenses.

Offers greater detail to a user or stakeholder. The higher level of detail included on the multi-step income statement comes from separating the companys expenses into several different categories including the cost of goods sold operating. Both single-step and multi-step income statements report on the revenues expenses and the profit or loss of a business during a specific reporting period.

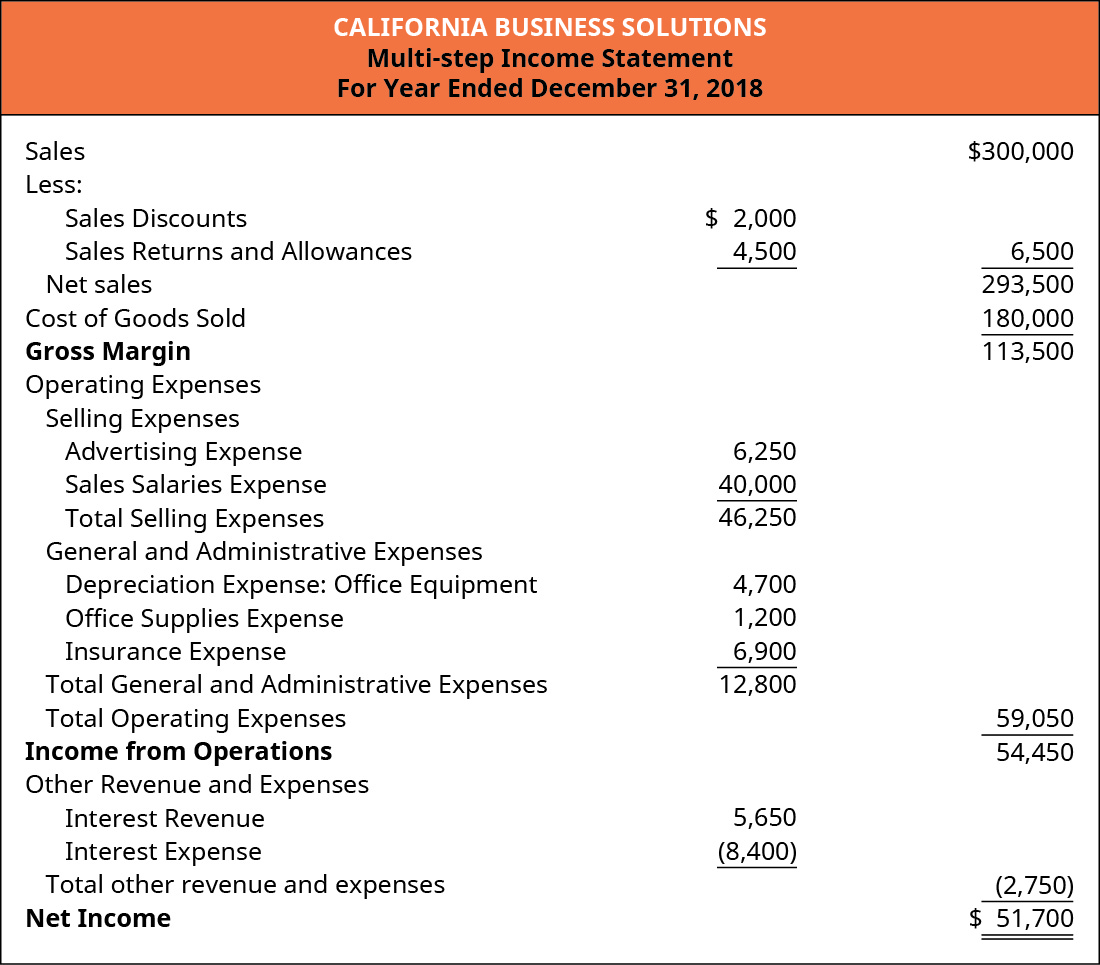

The first step in a multi-step income statement is calculating gross profit or gross margin. Multi-step income statements are one of the two income statement formats businesses can use to report their profits. The biggest advantage of using a multi-step income statement is that it shows operating and non-operating income as separate entities.

A multi-step income statement evaluates how a company earns a profit from its initial business activities. A multi step income statement assumes that the income and expenses of. Some of these a.

In this one splits the revenue and expenses into operational and non-operational streams. A multi-step income statement helps to give an insight into gross profit how a business uses labor and supplies to generate revenue. The siloed breakdowns in multiple-step income statements allow for deeper analysis of margins and provide more accurate representations of the costs of goods sold.

What is an advantage of using the multiple-step income statement. This reduces the financial clutter and highlights the most important of company financialsthe operational portion. Calculating gross profit or gross margin.

Definition of Multi-Step Income Statement.

Multi Step Income Statement Component And Uses With Example

A Beginner S Guide To The Multi Step Income Statement The Blueprint

Single Step Vs Multi Step Income Statement Key Differences For Small Business Accounting

Describe And Prepare Multi Step And Simple Income Statements For Merchandising Companies Principles Of Accounting Volume 1 Financial Accounting

No comments for "What Is an Advantage of Using the Multiple-step Income Statement"

Post a Comment